A Critical Look at CBDCs: The ECB President's Warnings on Crypto

Written on

Chapter 1: Understanding the Role of Money

Money serves as a fundamental means of control in society. As faith in centralized institutions declines, conversations surrounding Central Bank Digital Currencies (CBDCs) often act as unintentional publicity for cryptocurrencies like Bitcoin.

Central banks are exploring the introduction of digital currencies that are regulated directly by government authorities rather than private entities. This shift could reshape how we view and use money today.

While I don't subscribe to conspiracy theories, the necessity for governmental trust is evident. The public is understandably cautious about potential overreach, especially in light of recent monetary policies enacted post-pandemic.

In an era where personal freedoms have been questioned, the thought of having financial transactions monitored raises alarms. Increased scrutiny has already become the norm; regulations surrounding "Know Your Customer" (KYC) and anti-money laundering (AML) practices were intensified following significant events like the 9/11 attacks.

Section 1.1: The Implications of Surveillance

Many individuals prefer to live free from governmental oversight, even if it is framed as being in their best interest.

Christine Lagarde, the current President of the European Central Bank, has become a vocal advocate against cryptocurrencies while promoting CBDCs. Her campaign against crypto is alarming to many investors.

Subsection 1.1.1: Public Sentiment on CBDCs

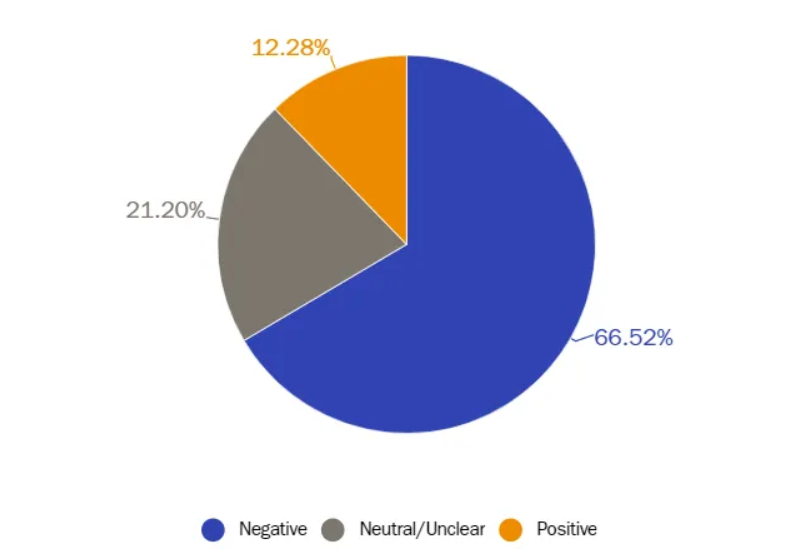

Surveys regarding CBDCs reveal a growing skepticism among the public. The Federal Reserve's request for feedback on its CBDC discussion paper resulted in over 2,000 comments, with more than two-thirds expressing apprehensions about financial privacy and potential governmental overreach.

Section 1.2: Lagarde's Controversial Stance

Lagarde has made bold statements against cryptocurrencies, claiming they lack intrinsic value and are purely speculative. Her remarks suggest a future where CBDCs could be tightly controlled, including limits on cash transactions.

Chapter 2: The Future of Financial Control

In her speech, Lagarde emphasizes the risks associated with investing in cryptocurrencies, warning that individuals may lose their entire investment.

As she outlines her vision for CBDCs, Lagarde’s approach signals a tightening grip on financial freedom, with proposed cash limits that could force individuals into compliance.

Final Thoughts

Lagarde’s push for CBDCs has ignited concerns among crypto investors, who view this as an attempt to stifle financial independence. The potential for governments to mismanage this initiative raises questions about public trust in their financial systems.

If not handled correctly, the discontent towards CBDCs could escalate into broader civil unrest. As governments consider the implementation of these digital currencies, the trade-offs between convenience and personal freedoms will continue to be a hot topic of debate.

Join my Free Newsletter today to stay informed with insights from leading experts in the fields of Crypto, Business, Finance, and Technology.

This article is intended for informational purposes only and should not be construed as financial, tax, or legal advice. Consult a financial advisor for significant financial decisions.