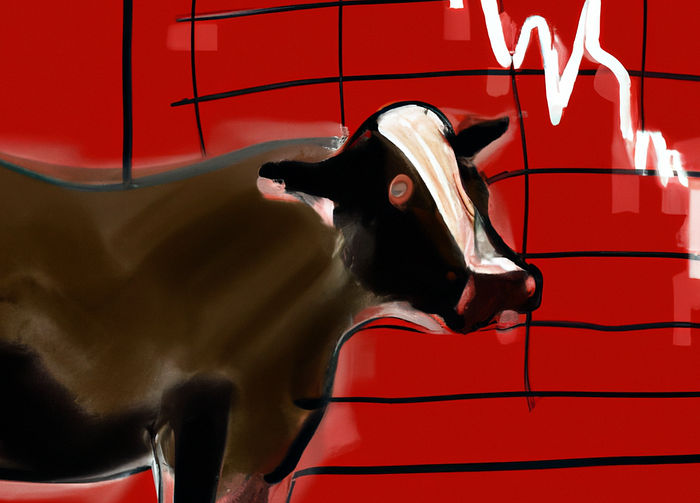

A Unique Indicator of an Imminent Recession: Cows and Consumer Trends

Written on

Understanding Economic Signals

Imagine if you had a reliable sign that a recession was approaching. Would you change your investment strategies? Increase your savings? Or perhaps put more effort into your job? Surprisingly, an unlikely recession indicator may be hiding in plain sight: cows.

The Buzz from the Cattle Market

The real insight comes not from the cows themselves but from the consumers shopping for them. A reliable approach to assessing economic health is to pay attention to what executives share during corporate earnings calls. Notably, insights from credit card companies and retail leaders are invaluable, as they are often the first to recognize shifts in consumer behavior.

Recently, Costco released its earnings report, and the company’s leadership expressed strong concerns about an upcoming recession. This apprehension stems from a noticeable decline in consumer interest in purchasing beef.

Shifts in Consumer Behavior

In an earnings call highlighted by Business Insider, Costco's CFO, Richard Galanti, informed analysts that customers are pivoting away from beef purchases and are instead opting for more affordable options like chicken and pork. Historically, such a change in buying patterns has served as a strong indicator that consumers are bracing for economic downturns.

Additionally, Galanti observed that an increasing number of shoppers are bypassing the fresh meat section entirely, favoring canned meats and fish for their lower prices and longer shelf lives.

A Cautionary Tale

According to Business Insider, while sales of Costco's budget-friendly Kirkland brand have risen, the average daily transaction volume at the store has decreased by 4.2% this quarter.

As a proponent of the idea that a significant stock market correction is imminent, I have seen some of the most prominent short-sellers making substantial bets against the S&P 500 and Nasdaq. When markets become as buoyant as they have in recent months, a correction often follows.

Unless you genuinely believe that 1,000% gains in meme stocks are sustainable, now may not be the time to dive into the next bullish market or crypto surge.

For my part, I choose to heed the warnings signaled by consumer behavior. It’s wise to remain hopeful yet prepared for potential downturns.

Disclaimer: This article does not constitute financial advice. It is intended for informational and entertainment purposes only. For any financial decisions, please consult a qualified financial advisor.

Chapter 2: The Impact of Consumer Choices on Market Trends

The first video titled "The 5 Foods You Will NEVER EAT Again After WATCHING THIS! | Dave Asprey" explores the significant impact of food choices on health and how awareness can transform purchasing habits.

The second video, "Are YOU Going To Be A Buffalo Or A Cow In 2023?" examines the implications of consumer mentality in economic contexts and what it means for financial strategies.